The Chancellor Jeremy Hunt has delivered his Autumn Statement ‘for growth’ to the Commons, outlining the government’s new tax and spending plans.

The statement looks to reward working people, boosting investment by some £20bn and ‘backing business with 110 measures’.

Hunt declared that the OBR (Office for Budget Responsibility) says the combined impact of his statement will be to raise business investment, get more people into work, reduce inflation next year and increase GDP.

For bathroom manufacturers, the key announcements include:

- Class 2 National Insurance paid by the self-employed will be abolished, and Class 4 will be cut to 8% from April 2024.

- Extension of “full expensing” for businesses permanently, which allows companies to deduct spending on investment from profits, meaning they have to pay lower amounts of corporation tax. The tax break was due to expire in 2026.

- £50m for engineering apprentices and “other key growth sectors” over the next two years.

- Following a review of the R&D tax relief schemes, the chancellor confirmed a merger of the two R&D tax reliefs into a single scheme will go ahead, with effect from 1 April 2024.

Also announced was £4.5bn for “strategic manufacturing” support between 2025 and 2030. Unfortunately, in this case, bathroom manufacturers will not benefit, as it refers to sectors such as aerospace, life sciences, and green industry firms.

Summary of the remaining headline announcements:

- Benefits will increase next year by 6.7%.

- An increase to the Local Housing Allowance rate to the 30th percentile of local market rents.

- Alcohol duty is frozen until August 1 2024.

- A commitment to the pension triple lock ‘in full’ with an 8.5% rise.

- Headline debt is now predicted to be 94% of GDP by the end of the five-year forecast period.

- Planning application reform to allow local authorities to recover the full costs of major business planning applications in return for being required to meet guaranteed faster timelines.

- Permitted development rights extended, allowing a house to be converted into two flats.

- Hunt will consult on giving pension savers a “legal right to require a new employer to pay pension contributions into their existing pension”.

- £500m investment over the next two years to fund more innovation centres to help make the UK an “AI powerhouse”.

- An extension to financial incentives for Investment Zones and tax reliefs for Freeports from five to 10 years.

- Mandatory work placements for job seekers still out of work after 18 months. Benefits will end if they choose not to engage in the work process after six months.

- The National Living Wage will rise to £11.44 an hour from April for those 21 and over.

- The main rate of employee National Insurance (NI) cut to 10% for 27 million people. Hunt will bring it in from Jan 6 2024, through urgent legislation.

Ending his address, the Chancellor claimed the Autumn Statement delivered “the biggest business tax cut in modern British history” and would return tens of thousands more people to work.

While the Chancellor is announcing his plans as a “tax-cutting budget”, overall, the tax burden is actually increasing to record highs.

The clear standout news from the statement is the cut to NI contributions. However, the OBR warned that fiscal drag (people being dragged into higher tax brackets than they otherwise would have been – or having more of their income caught in a higher bracket) will add £45bn by 2029 to the Treasury coffers. The cost of the NI cut will only cost the Treasury £10bn.

In further gloomy news, according to the OBR, the economy is forecast to grow slower than expected – 0.7% next year instead of the 1.8% previously forecast.

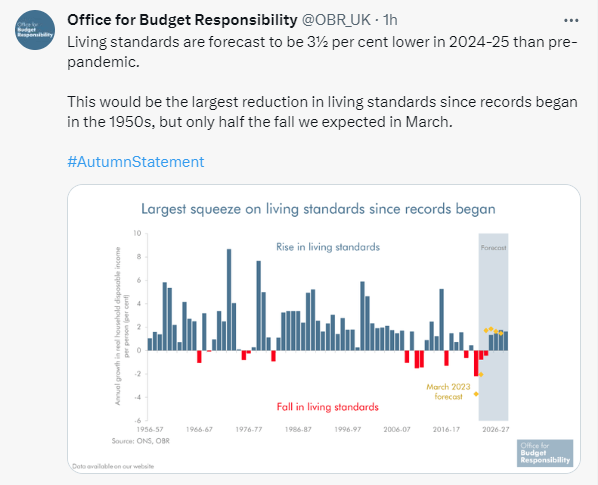

Indeed, the OBR say that living standards are forecast to be 3.5% lower in 2024-25 than pre-pandemic levels, suggesting that for all the fanfare of a NI cut, household budgets remain extremely tight.